Share this Post

MoneyGeek: ‘Expert Insight on Compound Interest’

What are some of the uses of compound interest?

Many people don't realize how much certain things will cost. Let's take retirement as an example. Most people work from their early 20s until their mid-60s, so we'll say about 45 years. With current life expectancy, they may retire for another 30-35 years after that! So in 45 years, you need to afford your own life as it comes while building a pool of money large enough to support you for another 30+ years into retirement.

This should include all living, medical and long-term care expenses. That is a lot of money. Then you add in inflation to see what that would cost you in the future, and that is even more money! We can't just save for retirement. We need our money to be saved for us as well.

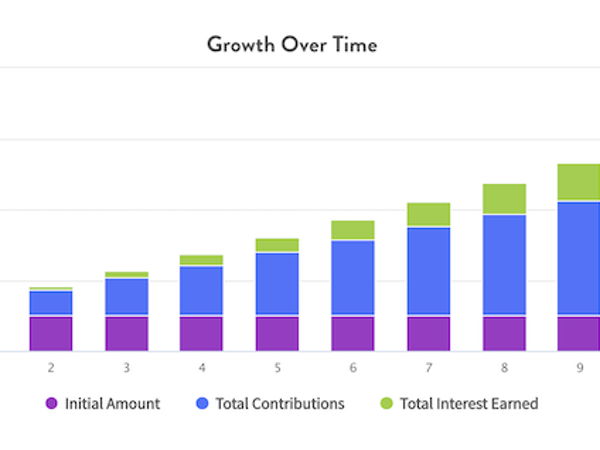

Compound interest allows us to grow money exponentially over long periods of time so that we can amass significant amounts of money to achieve goals like retiring, purchasing a home, sending our kids to college, and more. If we just put money aside, it will never be enough. We need our money to be making money, that makes money, that makes money, and so on in order to snowball the size of our available funds. That is compound interest.

How can compound interest affect you in a negative way (i.e., credit cards)?

Compound interest is neither good nor bad. It is inanimate. But it is a powerful force that can move in either direction, good or bad, depending on how it is used. While it can be used to amass incredible wealth, it can also amass incredible debt. Compound interest is cyclical; it is a snowball effect in either direction. It takes a pool of money and grows it at an interest rate. And then, the next year, that new pool of money (the original amount plus the newly incurred interest) grows by the interest rate again.

Yes, the money you earn in interest earns money in interest. That's how it compounds and snowballs. When it comes to savings and investing, this is a dream. When it comes to debt, this is very dangerous. You can make payments on a loan or credit card, but the balance isn't going down by that amount because you are then incurring more debt from the compound interest. It becomes a one-step forward, two-step back situation. This is why the majority of Americans have more debt than assets.

If planning your savings using compound interest, how should you think about the rate of return/assumption to include in your plans?

When building a financial plan, it is best to start with the end in mind. What do you want your life to look like in x number of years? When you imagine that life, where are you located? Who are you with? What is your quality of life? Then you begin to build out what you would need to achieve that life. With those numbers in mind, you work backward. You survey your current cash flow to see what you can save or invest. Then you project that out over the desired time and calculate what rate of return you would need to turn your current savings into the amount needed to achieve your desired outcome in the future.

Now, if it were that easy, everyone would achieve their goals, which unfortunately isn't the case. This is when real life kicks in. What if you need a high rate of return, like a 10% annual average? You will need investments heavily weighted in the stock market, which will incur higher volatility swings. If you are comfortable with that, then let's move forward. If you are not, then we will need to adjust. Sometimes the plan assumes a required rate of return, and the individual or family feels uncomfortable with what it could cost to achieve that return. That's when we will need to either extend the time until the goal is reached or save more from the current cash flow.

The rate of return is always an assumption, not a science. It is based on long-term historical averages, which is the information we have. But every investor needs to realize that a financial plan is not a crystal ball. There is always a chance that over the next 20 years, the investments chosen will deliver a lower (or higher) average rate of return than the current historical average. The past does not indicate the future. That is why it is important to build the plan around available cash flow, the desired outcome, time and the required (expected) rate of return, but to review the plan then regularly to make any necessary changes.